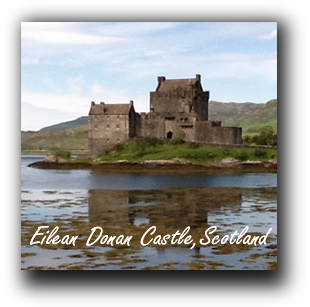

Having just returned from a month of castle touring throughout England, Scotland, and Wales, I can’t help but see actuaries in a defensive posture helping to defend your kingdom and all those middle market accounts! I thought about writing a grand 14th century analogy – but, decided to spare you.

Having just returned from a month of castle touring throughout England, Scotland, and Wales, I can’t help but see actuaries in a defensive posture helping to defend your kingdom and all those middle market accounts! I thought about writing a grand 14th century analogy – but, decided to spare you.

In 2010, we sold Specific Software Solutions, LLC to Zywave, Inc. Since then, my focus has been on helping brokerage firms better integrate actuarial services into their sales and servicing process. A recent article in Business Insurance Magazine really backs up what we have been preaching during the past year – you need actuarial resources to acquire and retain mid-market accounts.

I encourage you to read the article at:

https://www.businessinsurance.com/article/20110717/ISSUE03/307179987

But, here are two of the main points from the article I want to draw your attention to:

- The success of the big firms often depends on how well the “megabrokers” can emulate the “personal touch” and industry-specific knowledge of regional and local brokers.

- The success of the regional and local brokers is going to be their ability to deliver “ancillary” services. Actuarial services are one of those critical services.

Coincidentally, about the same time the Business Insurance Magazine article was published, an article entitled “Battle for the Middle Market: Leveling the Playing Field” was published by RoughNotes. I particularly like this article because it mentions some of the unique resources we have developed here at SIGMA as part of our Powered by SIGMA for Brokers program. I encourage you to read this article, also found in our SIGMA portal.:

In an effort to educate our audience on the benefits of actuarial resources, we recently sent out a personal invitation for onsite training to a limited number of early Powered by SIGMA registrants (registration is free). The response was overwhelming – so much so that we can’t visit everyone in a timely manner. Because of this, we have developed our Lunch and Learn Training. This straightforward, 35 min presentation will show your producers and account executives how to 1) Assess an employers need for actuarial services, 2) How to guide a conversation for more in-depth assessment, 3) How to respond to the employer using resources found in the Powered by SIGMA portal.

In an effort to educate our audience on the benefits of actuarial resources, we recently sent out a personal invitation for onsite training to a limited number of early Powered by SIGMA registrants (registration is free). The response was overwhelming – so much so that we can’t visit everyone in a timely manner. Because of this, we have developed our Lunch and Learn Training. This straightforward, 35 min presentation will show your producers and account executives how to 1) Assess an employers need for actuarial services, 2) How to guide a conversation for more in-depth assessment, 3) How to respond to the employer using resources found in the Powered by SIGMA portal.

To get started,

1. Register for access to our free resource portal at www.SIGMAactuary.com/register

2. Download the “Lunch and Learn with SIGMA Guide” and PBS Case Study Documents

3. Download or stream the Powered by SIGMA for Brokers Video Presentation

We will also send you a complementary PBS training manual if you will let us know when you are planning the lunch & learn date. To receive your copy, email me at TLC@SIGMAactuary.com

I look forward to hearing from you and learning more about your business and your goals and how SIGMA can be a resource that helps you succeed.