In the SIGMA Tech Talk titled “Understanding Loss Development Factors,” we introduced IBNR losses as those losses which occur during a loss period but are not reported until a later date. The definition of IBNR also typically includes development of known claims. In this article, we look further at the significance and calculation of IBNR losses. An insurance program analysis includes a calculation of outstanding liabilities for all incurred claims. These liabilities are a key component of the costs associated with funding the program. The outstanding liabilities almost always exceed the reserves found on a loss run. The reserves are an estimate of future payments for each individual claim. The sum of the reserves does not equal outstanding liabilities because this sum excludes the impact of IBNR.

An IBNR analysis is most frequently prepared for a self-insured trust, a captive insurance company, a corporation that uses a loss-sensitive cash flow plan, or as part of the due diligence process for mergers/acquisitions or divestitures. Specifically, an IBNR analysis is often used as part of

-

-

- An actuarial reserve certification

- Satisfaction of self-insurance requirements

- Negotiation of security requirements and letters of credit

- Acquisition due diligence

- Evaluation of expected liabilities for financial statements

-

Basic Methodology

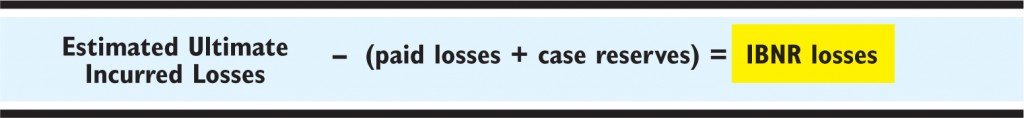

The calculation of IBNR can be summarized as follows:

-

-

- Ultimate loss estimates are calculated for each policy period using one or more actuarial techniques.

- The ultimate loss estimates from each technique are compared and a selection of ultimate incurred losses is made.

- Paid losses and case reserves are subtracted from the estimated ultimate incurred losses to calculate the IBNR losses.

-

Gathering and Analyzing the Data

An IBNR analysis requires three major steps:

Step 1: Gather the necessary data. Required data includes incurred losses and paid losses summarized by policy period. The losses should be limited to per occurrence and aggregate limits. Any actuarial analysis is only as good as the data utilized. A credible IBNR analysis requires good data in several areas. First, you need a current loss run. This allows the calculation of ultimate losses without relying on industry average severities and frequencies. Second, you need prior annual evaluations of losses for past policy periods. This information is used to calculate unique loss development factors. Finally, you will want information pertaining to the policy limits for the past years. This includes per occurrence (individual loss limits stated in the policy) and aggregate limitations (maximum aggregate liability for the insured). With this information, you can correctly limit the losses and more accurately calculate the IBNR losses.

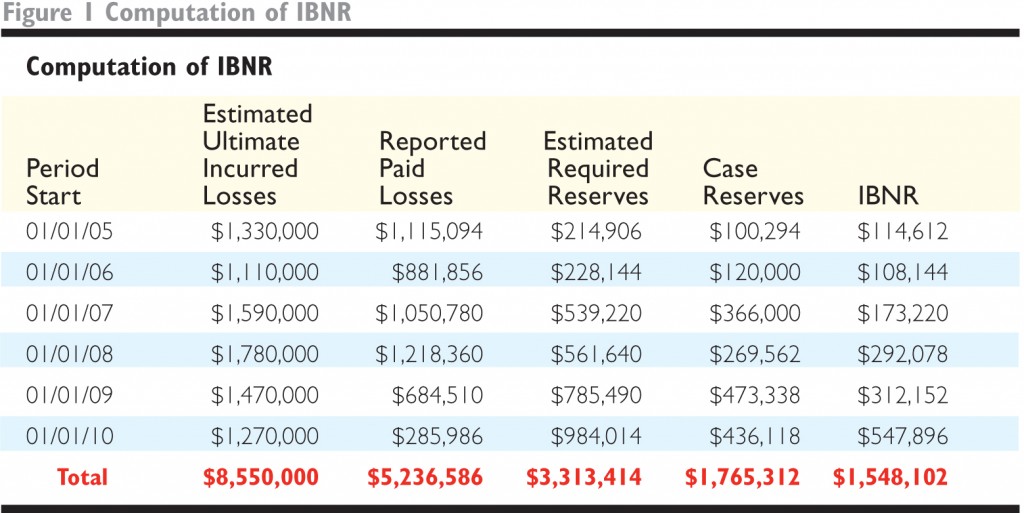

Step 2: Adjust the limited losses determined in step 1 to an ultimate cost level. The most common technique is to use loss development factors (see “Sources of Loss Development Factors” in the next section). These factors quantify the late-developing aspects of certain losses. They also account for losses that occurred during a period but are not reported until a later date. The ultimate losses for each period are estimated by multiplying the development factors by the reported losses for each period. If you are using both incurred and paid losses, then you will have to select a weighted average of the two estimates of ultimate losses for each period. As shown in Figure 1 below, estimated ultimate incurred losses are defined as the amount needed to provide for the cost of claims relating to events that occurred during each period.

Step 3: Subtract reported paid losses from the estimated ultimate incurred losses to arrive at the estimated required reserves, which is the amount that will be required for future payments on

-

-

- 1. claims that have been reported and

- 2. claims that have occurred but have not been reported as of the evaluation date.

-

The estimated required reserves can then be segregated into case reserves and IBNR. Case reserves are computed as the difference between the incurred losses (not shown in Figure 1) and the paid losses. Therefore IBNR includes development on known claims as well as a provision for claims that have occurred but not been reported as of the evaluation date.

Sources of Loss Development Factors

There are a number of sources of loss development factor data. Actuaries, brokers, insurance companies and risk management consultants all gather this information. But the information received from an external source may not be appropriate for every situation. If historical data is available, unique loss development factors should be calculated since they will allow for a more accurate reflection of specific loss development patterns. Theoretically, the use of unique factors instead of industry averages produces a more accurate projection of ultimate incurred losses.

Requirements for a Credible IBNR Analysis

While we discussed data gathering in step 1 at the beginning of this article, it is important to emphasize the need for sufficient and quality data. Occasionally, analyses are completed with less than sufficient data when an actuary is not involved. Actuaries typically have methodologies or industry data that can be used in situations where the quantity or quality of data is not ideal. If you do not have the necessary data for an IBNR analysis, be sure to contact an actuary for advice on how to complete the analysis.

We welcome your feedback by posting a comment or contact us at support@SIGMAactuary.com.

Don’t forget to register for our free resource portal by visiting: www.SIGMAactuary.com/education

© 2011 SIGMA Actuarial Consulting Group, Inc.

Good basic article. I would be interested in learning more about application to Captive programs. Who do you typically see as qualified actuaries in this arena?

The IBNR component is why actuaries are so critical to the process. An actuary calculates the IBNR so the captive domicile regulator will know if the captive is adequately funded. We are an actuarial consulting firm. I can have one of the actuaries call you and answer any questions you may have.