With the increasing complexity of products and services in today's market, warranty and extended service contract programs require sophisticated actuarial analysis to ensure proper risk management. Companies offering these programs need to understand the distinction between manufacturer warranties and extended service contracts, as well as the unique characteristics of warranty risk analysis compared to traditional insurance coverages. As an excellent supplemental resource to this blog, we recommend reviewing Common Questions on Warranty Risks and Coverages.

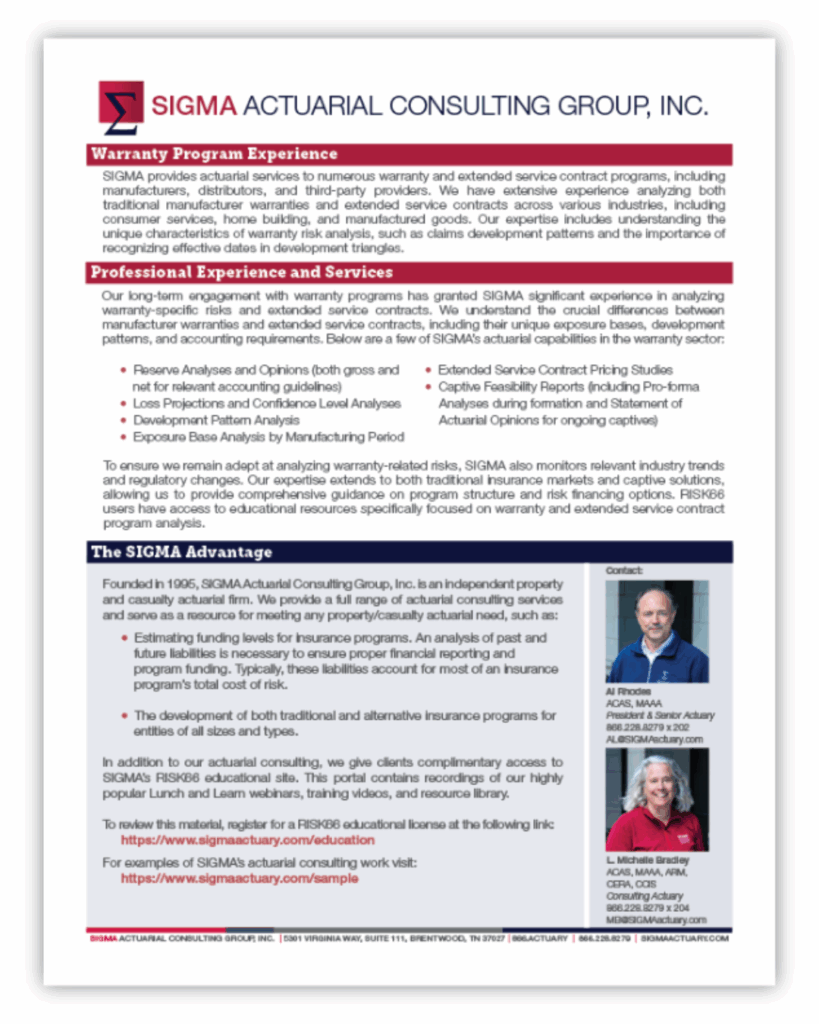

SIGMA has significant experience providing analytical services to companies with warranty and extended service contract programs, which is the topic of our latest one-page summary. In addition to outlining the types of services SIGMA offers and highlighting our experience with various types of warranty programs, the summary below includes key data and program information requirements necessary to support accurate analyses. Our latest one-pager is just one of the many documents and videos found in our complimentary RISK66 education portal. Already a user? Login.

To facilitate timely and effective analysis of warranty and extended service contract programs, SIGMA relies on a well-defined set of data and contextual information. The following outlines the key information and data elements typically needed to begin an effective analysis. While this represents an ideal set of inputs, SIGMA can discuss alternative formats or data limitations on a case-by-case basis.

General Information:

- A summary of the company’s operational history, including duration of warranty issuance.

- A description of the company’s warranty coverage, component applicability, warranty period, and sample contracts.

- For any underlying manufacturers’ warranties, details of coverage, component applicability, warranty period, and sample contracts.

- A comparison of manufacturer versus company-provided warranty coverages, including whether manufacturer warranties extend to the company’s benefit.

- Historical failure rates for covered components.

- Cost estimates for repair or replacement of covered components.

- A description of the methodology used to determine the initial warranty cost estimates, including underlying assumptions and failure rates.

Data Requirements:

Exposure and loss data are essential for an effective actuarial evaluation. Detailed, component-level information is preferred. For example, a separate record should be provided for each component within a warranty or claim, particularly when multiple components are involved. However, if such granular data is unavailable, appropriate aggregate reports may be considered. Warranty data from both the company and the manufacturer should be provided, with clear indicators if combined. Historical data over longer periods is particularly valuable when analyzing extended warranty programs.

Exposure Data: Contract and Component Level

Each warranty should include:

- Warranty contract number

- Date Issued

- Component covered

- Location

- Embedded cost of warranty by component

- Current replacement cost of comparable unit and component

- Any other relevant information

Loss Data: Claim and Component Level

Each claim record should include:

- Claim number

- Component involved

- Date of loss occurrence

- Date claim was reported

- Date of repair or replacement

- Type of resolution (repair vs. replacement)

- Cost of repair/replacement

- Associated warranty contract number

- Warranty contract issue date

- Location

- Any other relevant information

Meaningful actuarial insights depend on high-quality data and a comprehensive understanding of the warranty program. By working collaboratively with our clients to obtain this information, SIGMA ensures our analyses support effective financial decisions and risk management strategies.

As always, SIGMA is available to discuss solutions to challenges unique to a particular company or industry. Schedule a call today with one of our consulting actuaries.

We welcome your feedback by contacting us at support@SIGMAactuary.com.

© SIGMA Actuarial Consulting Group, Inc.