When companies are determining a large deductible policy structure for their P&C risks, it is unfortunately all too common for the final decision to be based on “back of the napkin” calculations. This is often due to a lack of time, resources, or comfort in using more effective analytical approaches.

One of SIGMA’s objectives as an actuarial consulting firm is to reduce the perceived gap that stands between insurance professionals and their ability to utilize analytics in their risk-based strategies. Whether it stems from a lack of knowledge or access to helpful tools, we are always working to close that gap and extend the benefits of actuarial analytics to as wide an audience as possible. It is with this objective in mind that we are proud to announce the public release of our Large Deductible Tool, which can be accessed by registering for a complimentary RISK66 Education License.

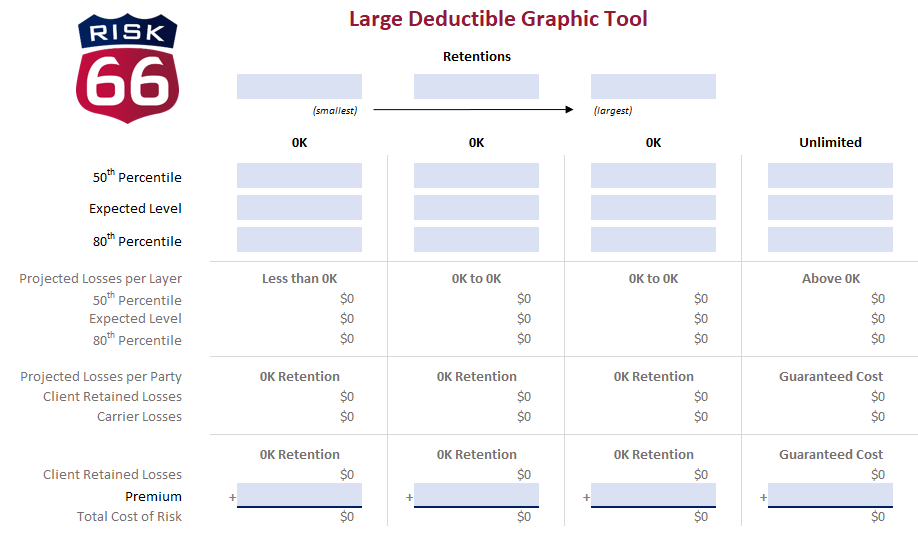

As covered in our May 2023 Lunch & Learn Webinar, the Large Deductible Tool offers a streamlined, graphical approach to determining the most likely cost-effective retention for a large deductible policy. Using projected loss (or loss pick) and premium quote information, this tool calculates an expected total cost of risk, examines the projected losses at specific confidence levels, and breaks down the potential loss amounts retained by a company and their carrier.

The results of the tool are then presented in a graphical format which is meant to be easily interpreted and converted to a PDF. As always, analytics are only useful if they can be conveyed in an effective manner, so the Large Deductible Tool was designed from the ground up for ease of presentation.

The team at SIGMA is confident in the user-friendly approach of all our tools and resources, but we also recognize that comfort with analytical topics doesn’t always come naturally. Our resource library and video training portals in RISK66 are both great ways to get yourself acclimated to the terms and methods used in actuarial analytics.

We welcome discussion with any of our insurance colleagues who want a better understanding of these topics, and those wishing to contact us can do so at support@SIGMAactuary.com or by scheduling a call today with one of our consulting actuaries.

© SIGMA Actuarial Consulting Group, Inc.