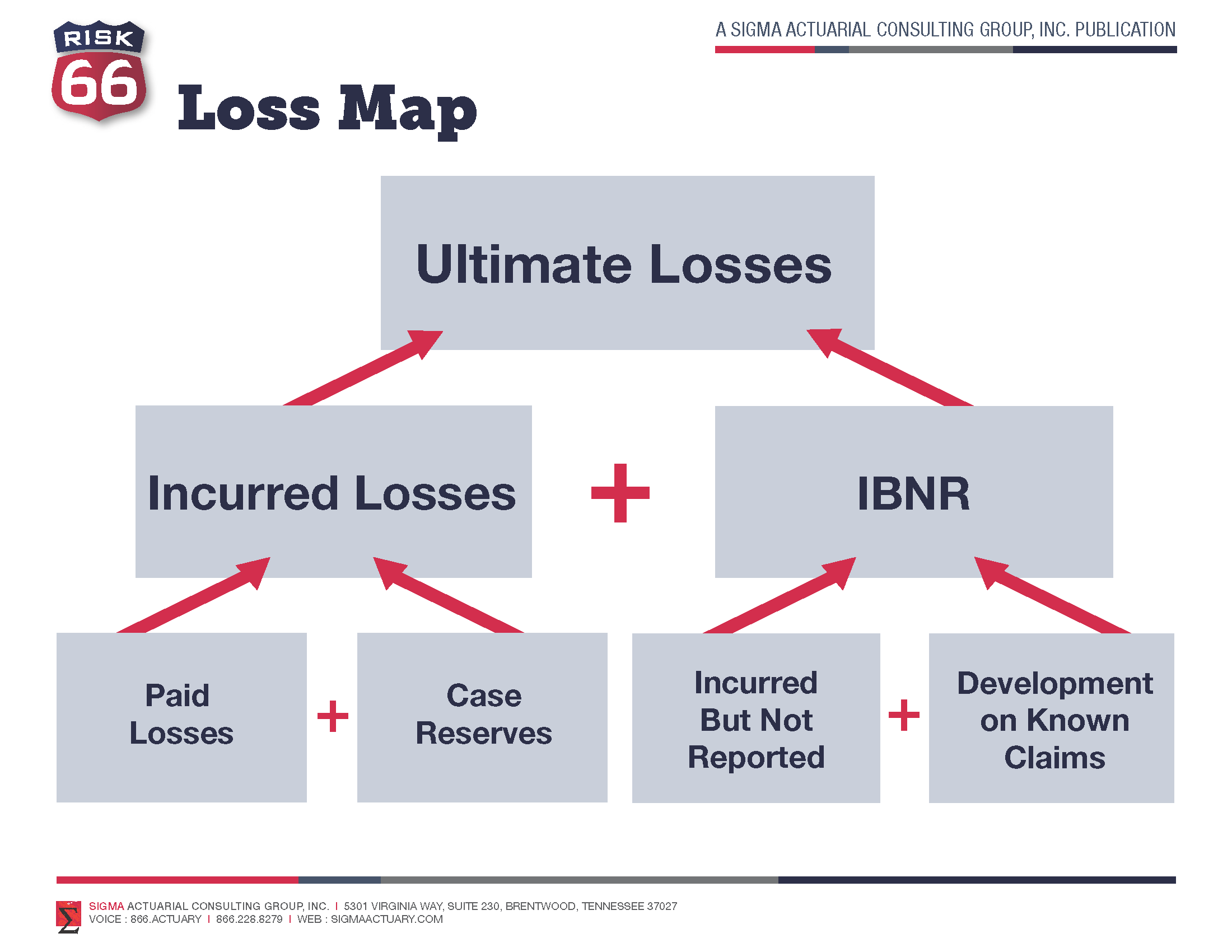

This blog introduces a graphic that shows the pieces that make up “Ultimate Losses.” The ultimate losses of a policy period will typically not be known for many years. Actuaries are hired to estimate ultimate losses to help a company use appropriate reserve amounts for planning and financial statement purposes.

Here are some definitions for the terms contained on the “Loss Map” graphic:

Here are some definitions for the terms contained on the “Loss Map” graphic:

(Note: these terms are also defined in the booklet “Actuarial Advantage” which is a free resource found in our portal at www.SIGMAactuary.com/resources)

Ultimate Losses– The estimate of the ultimate value of claims for a policy period.

Incurred Losses– A statement of the loss amount for a policy period that includes both paid losses and unpaid case reserves.

IBNR–This value includes losses for claims that occurred during the policy period that have not been reported. IBNR also includes development on known claims. Most of the IBNR tends to be development on known claims.

Paid Losses– A statement of the loss amount for a policy period that includes only the amount actually paid on the claims.

Case Reserves– A loss amount budgeted for future payments on reported claims.

Incurred But Not Reported – This value includes losses for claims that occurred during the policy period that have not been reported.

Development on Known Claims– This value includes additional losses for claims that occurred during the policy period that have been reported.

The phrase “Incurred But Not Reported” is used twice due to how the definition has evolved.

As always, please comment or email us your thoughts and comments to TLC@SIGMAactuary.com

© 2012 SIGMA Actuarial Consulting Group, Inc.