Business strategy is my favorite business subject. Recently, I started a doctoral program at Oklahoma State University to work toward a PhD in Business. Strategy is one of the first “deep dives” of the doctoral program and it seemed fitting to start off this year’s blog discussing strategy, specifically, how does SIGMA fit into your strategy.

Business strategy is my favorite business subject. Recently, I started a doctoral program at Oklahoma State University to work toward a PhD in Business. Strategy is one of the first “deep dives” of the doctoral program and it seemed fitting to start off this year’s blog discussing strategy, specifically, how does SIGMA fit into your strategy.

In this blog, I assume you have a strategy for your agency or brokerage firm (I’ll use the term “firm” in the remainder of this blog).

Rather than provide you with a lot of abstract theory about strategy, I have decided to focus on a very specific part of your strategy – differentiation. Recently, I read a comment that said, “You can’t differentiate yourself if you don’t have anything different to offer.” I think SIGMA is that difference maker for you and I wanted to give you a list of two ways to present SIGMA to your clients, using our resources in the Powered by SIGMA portal, in a manner that will differentiate your firm.

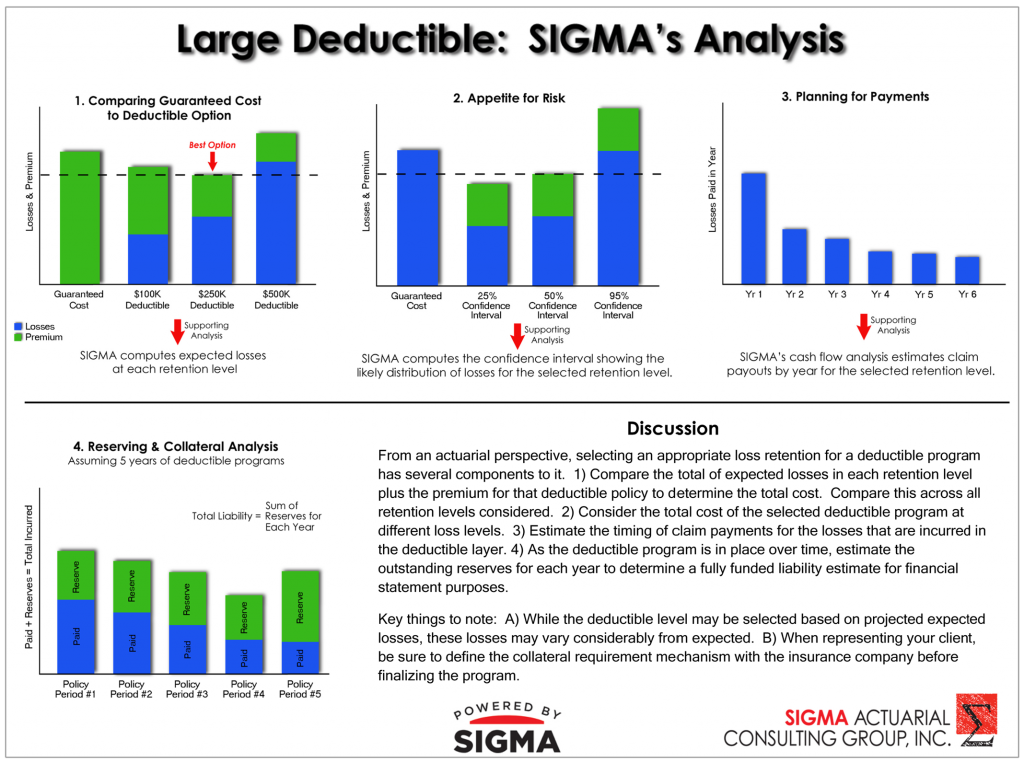

1) Email or write prospects in your market that you believe have some type of loss sensitive or deductible program. Attach the deductible analysis graphic (see picture below) and use text similar to the following:

“In our experience, the selection of a deductible program is typically not based on solid analytics. We have partnered with SIGMA Actuarial Consulting Group, Inc. to deliver a robust analysis of deductible options. This analysis will estimate the expected losses within different deductible layers and combine this with pricing information to determine the lowest cost of risk. If you are interested in bringing the latest in analytical decision making to your selection of a loss sensitive program, please contact me directly. I have attached a graphic that gives a quick overview of the type of analysis we can complete for your organization.”

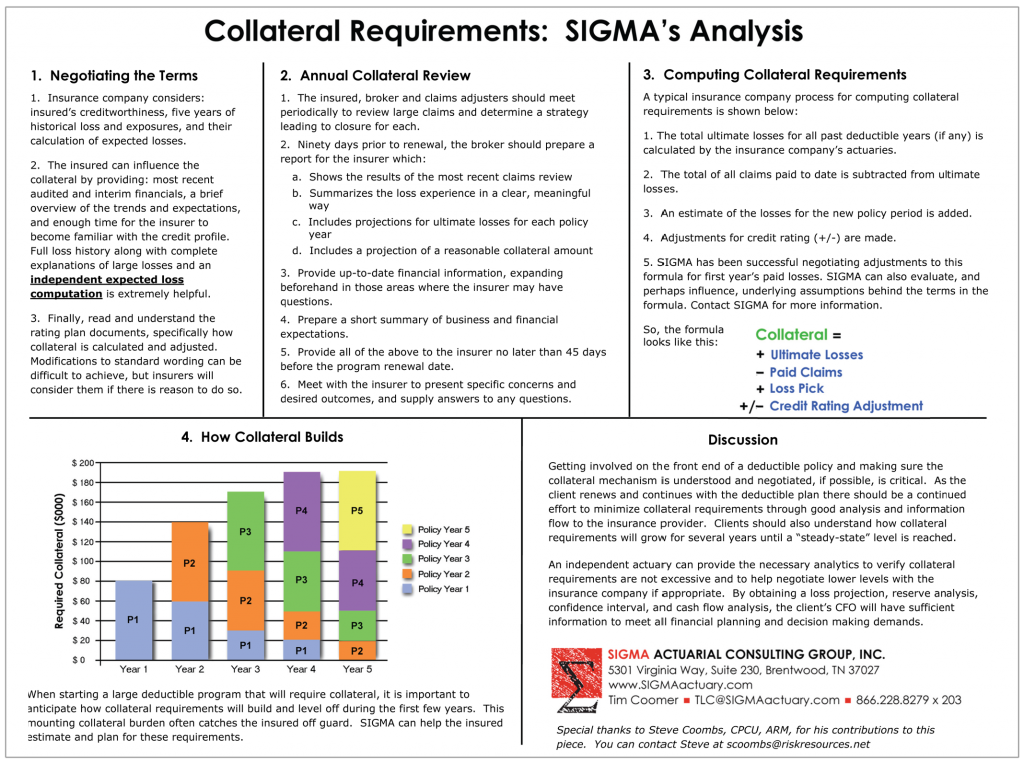

2) Email or write prospects in your market that you believe might have collateral related issues or concerns. Attach the collateral graphic (see picture below) and use text similar to the following:

“Insurance companies have become notorious for keeping collateral requirements high for those with a large deductible program. If you have experienced this, then you know how difficult it can be to get reasonable adjustments to collateral requirements, especially when you have years of deductible programs. In our experience, we have found that the analysis of an independent third party, like our partner, SIGMA Actuarial Consulting Group, Inc, can play a pivotal role in successful collateral negotiations. If you would like to discuss this further, please contact me directly. I have attached a graphic that gives a quick overview of collateral issues and strategies.”

Finally, where does an actuarial resource like SIGMA fit into your strategy? We solve problems for your clients and support better analytical based decisions. A very limited number of firms can bring actuarial and analytical resources to the table. By partnering with SIGMA, you instantly create a whole new wing of your business which involves no overhead, but provides access to resources and personnel ready to be engaged on a moments notice.

Here at SIGMA we are committed to bringing resources to you that help you succeed. Most of my doctoral work will be focused on topics that will serve the SIGMA clientele, independent agents and brokers and their clients. If you have topics of interest that you would like to share with me, I would benefit from hearing them as I work to identify different topics to research.

Both of the graphics mentioned above can be found in our free, "Powered By SIGMA" resource portal. Sign up today at: RISK66.com

As always, feel free to email me directly with your comments at TLC@SIGMAactuary.com.

I wish you a very successful 2014.