Case 3: Assessing Changes to Loss Development Factors

Case 3: Assessing Changes to Loss Development Factors

The information provided thus far in SIGMA’s pandemic-related case studies has been met with fantastic feedback. In a recent Lunch & Learn webinar reviewing and expanding on the first case study, we received a very insightful question on whether loss development factors may be impacted by these changes and, if so, to what degree? Questions such as these highlight a very important and growing concern within the insurance industry – how will the pandemic affect loss experience moving forward?

Many businesses have found themselves adapting to an evolving economic landscape, and their risk profiles are shifting accordingly. A litany of risk-related areas may be impacted by this, from claim handling philosophy to the frequency and severity of incoming claims, and one of the primary methods of recognizing these changes occurs in the loss development factors. Measuring or anticipating potential changes will likely be a complex process that varies from business to business, but today’s article should clarify a few commonalities that can be assessed or evaluated to help with this task. As with previous articles, our focus will lie primarily on workers compensation, but the suggestions should be applicable to other coverages as well.

Before we go further, though, we encourage our readers to review the commentary put forth in the second blog in this series, which focused on the role of claim lag analytics in detecting and monitoring trends. Claim lags relate directly to loss development, so the impacts presented in that article may overlap and inform today’s topic.

Measuring the Impact

Incurred and paid development methods are often used to estimate ultimate losses for historical policy periods. Since these estimates are then analyzed in the projection of future losses, significant shifts in loss development factors could impact the projection. In order to measure this impact, an examination of a company’s unique loss development triangles is necessary.

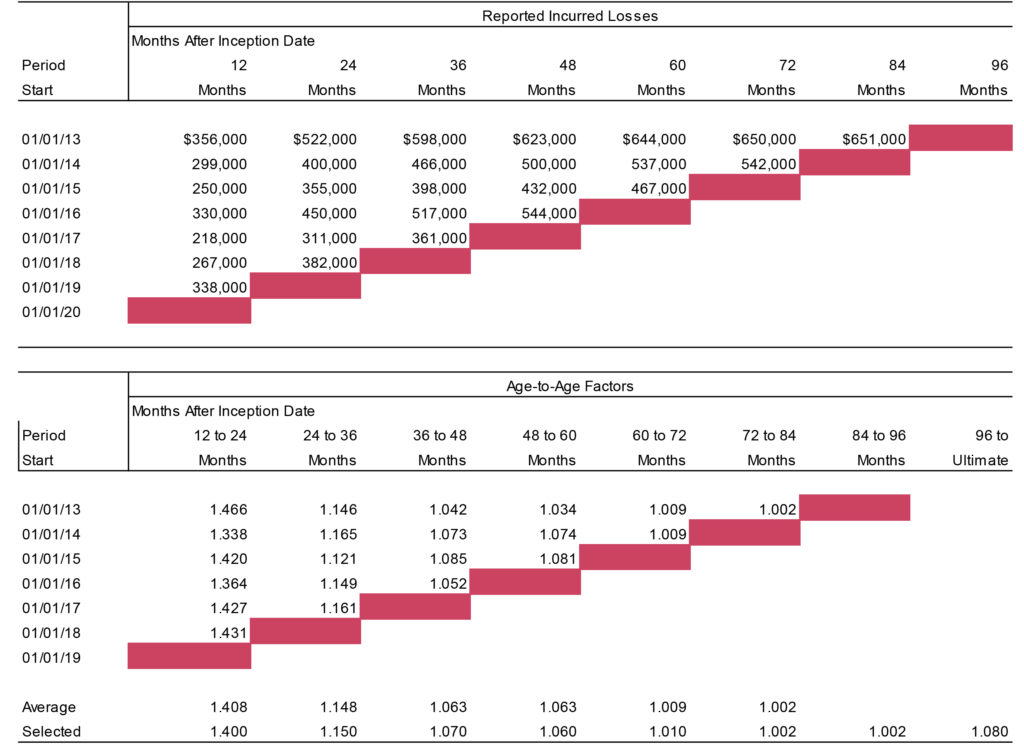

The first step in this process is identifying the loss development factors which reflect the current reserving and payment environment - these are located on the current diagonal. As an example, we’ve highlighted where the current diagonal would be in the triangle shown below.

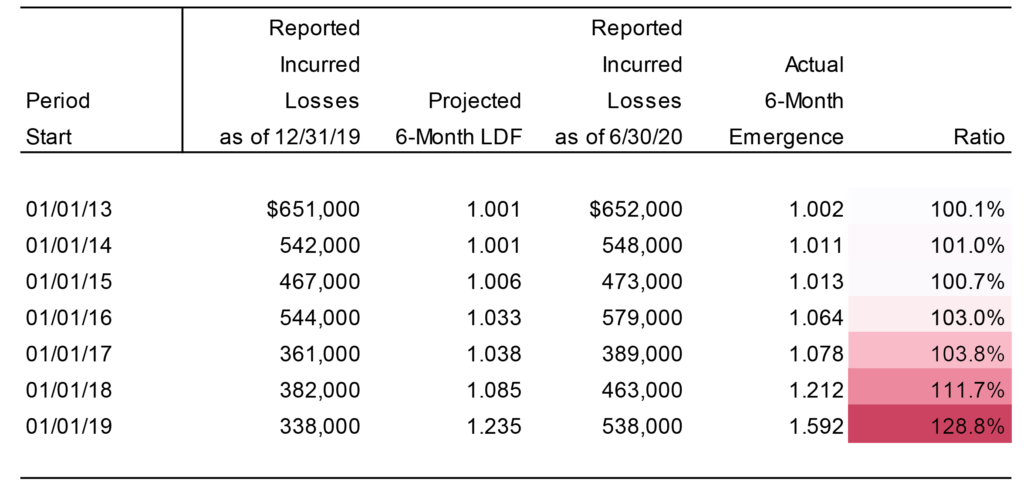

For triangles compiled on an accident year basis at twelve-month intervals, the above example highlights an important issue: measuring age-to-age improvement or deterioration may take time, as measurements are made over annual accident or emergence periods. Fortunately, there are several methods of overcoming this obstacle, one of which is examining mid-year emergence. In the following exhibit, we’re comparing the expected loss development from 12/31/19 to 6/30/20 against the actual loss emergence.

As you can see, doing so allows us to take a preliminary look at the actual loss experience over six months and gauge how it compares to expectations. Note the differences between actual and expected development for the 1/1/18-19 and 1/1/19-20 periods. Both periods are clearly developing higher than expected, indicating a potential deteriorating trend. It’s important to remember that these amounts are not measuring the full 12-month development, though, so any insights or measurements should be made with that caveat in mind. Of equal significance is contextual knowledge. Some situations, such as seasonality in claim frequency, may be the underlying reason for early emergence deviating from the historical norm.

Key Considerations

While examining loss emergence serves as a good first step in evaluating trends, other considerations should be made in order to produce a more complete, fully contextualized understanding of the impact. To help guide this process, we recommend reviewing the following questions:

- What constitutes "real" change?

- - Consider using your own loss history to answer this question. Averages and other calculations may be made from historical age-to-age factors to provide a relative range within which preliminary experience could be considered “normal”.

- If there is improvement or deterioration, how long will it last?

- Are any of the measured changes likely to be anomalous?

- - In other words, could these changes simply be “blips” that are unlikely to be repeated, or are they indicative of future experience?

- - As an example, consider the heightened employee awareness associated with increased safety standards. Is this likely to wear off over time, or will it continue?

- Are decreases in frequency or overall exposure being contemplated?

- - Note that decreases in frequency may not affect development.

- - Similarly, decreasing exposures related to furloughs or shutdowns do not imply changes in the development factors.

- Is there an understanding of what causes new trends in loss development?

- - Changes in claims administration, claim mixture, and claim severity are typically the primary drivers of these trends.

- - Emerging claim types related to the virus may present themselves very differently from historical patterns.

- Are the potential impacts of regulatory or judiciary changes being recognized?

Conclusion

As mentioned earlier, the role loss development factors play in estimating historical ultimate losses means that anything impacting them will also affect upcoming loss projections. Thus, knowing how to recognize and measure these changes allows key decision-makers to ensure their funding on future periods is adequate and reasonable. While these measurements can be made using preliminary mid-year data, quarterly or bi-monthly loss examinations may also be useful when tracking possible changes in the age-to-age factors

Note, however, that integrating these measurements and analytics into your standard methodology should not necessarily lead to immediate or drastic changes in LDFs. Instead, these methods should inform future changes and discussions. Having more data points available for analysis will lead to increased insight and comfort with the ensuing decisions, so we strongly encourage you to supplement loss development analytics with the other suggestions listed in SIGMA’s prior case studies.

If you’d like to know more about loss development factors, we’ve provided a list of related SIGMA blogs below. These should provide you with a better understanding of the basics of loss development factors and the associated development methods relying on these factors. Many of these also address how loss development factors are impacted for a changing environment.

Understanding Loss Development Factors

Common Mistakes using Loss development Factors

Understanding Actuarial Methods

Conversation on Loss Development Factors

The Analytically Based Data-Driven Broker: Loss Development Factors

If you have any questions about today’s topic or the article linked above, feel free to contact us at support@SIGMAactuary.com.

© SIGMA Actuarial Consulting Group, Inc.