Most companies and their consulting actuaries complete an actuarial analysis annually at minimum in order to assist in determining booked reserves for outstanding losses & LAE in their year-end financial statements. As the estimates are revised year to year, management may seek to isolate and review specific items attributing to any changes in these reserves. Additionally, during the budgeting process, it is necessary for management to determine a reasonable provision for expected reserve changes through the upcoming year. Various approaches may be used to determine this type of provision. This article focuses on a straightforward process for reconciling the estimated required reserves from year to year.

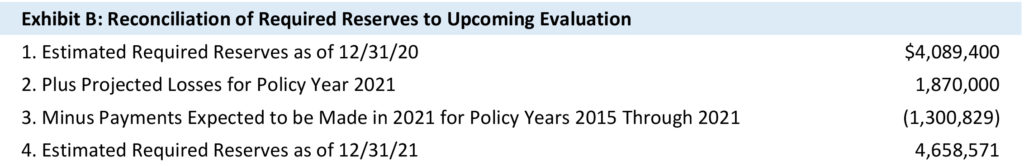

Reconciliations may be either retrospective or prospective. Retrospective reconciliations compare the estimated required reserves calculated based on a prior data evaluation to those calculated based on the current data evaluation. Specific events happening over the past year which attribute to changes in current reserve estimates are itemized. Prospective reconciliations begin with the estimated required reserves calculated based on the current data evaluation and project the provision for specific events which are expected to affect the reserves over the upcoming year.

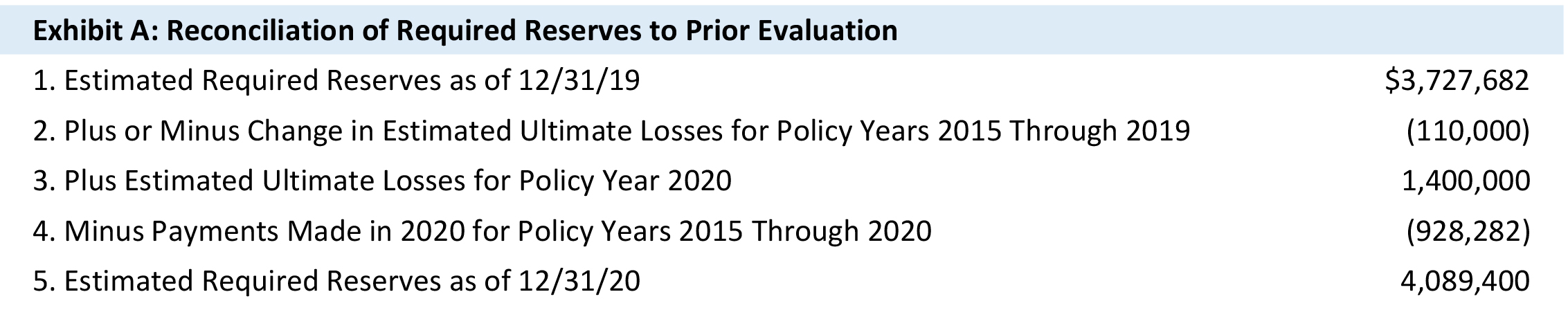

A common retrospective reserve reconciliation is shown in Exhibit A for a program beginning in 2015. Line 1 begins with the reserves calculated in the prior actuarial analysis. Line 2 shows the change in the estimate of ultimate losses for historical policy years between the two data evaluations. This includes changes in case reserves – amounts determined by claims administrators and shown on the loss runs – and development on known claims and incurred but not reported (IBNR) losses – amounts determined by actuaries in each analysis. In the example, the ultimate loss estimate improved, perhaps due to a claim settling for less than anticipated. Ideally, from an actuarial standpoint, line 2 would change minimally from year to year. Large swings in this line item may demonstrate the impact of reinforced efforts to manage and settle claims favorably or alternatively serve as an indicator of emerging adverse trends.

Line 3 adds a provision for the ultimate loss value of new claim occurrences, whether known or IBNR, for the recent policy year. This estimate is based on the current data evaluation. Line 4 gives a credit for payments made over the past year on all known claims. Lines 3 and 4 should approximately offset each other for a stable program or have minimal net effect due to annual inflation. The net effect would be larger for companies experiencing strong growth or decline in their loss experience and/or exposure. Payments over the past year which are significantly higher or lower than average would also impact the net effect of these two lines. The sum of the prior reserve estimate and these itemized changes balances to the current reserve estimate shown in line 5.

Reconciliations in both examples are shown for one coverage. For companies retaining losses for multiple coverages, it is important to complete a reconciliation for each coverage separately in order to isolate changes for individual coverages. Payment patterns will also differ by coverage. Though indications for certain coverages may increase or decrease, totals for all coverages combined may prove to be stable for companies retaining a large number of coverages.

A similar process may be used to reconcile reserves over shorter time periods or in the interim of full actuarial reserve analyses. Some companies who use SIGMA’s RISK66 portal choose to true up their reserves monthly or quarterly based on results from SIGMA’s Loss Forecaster model. Using Exhibit A as an example, Lines 2 and 3 could be determined based on Loss Forecaster results and Line 4 could be determined based on the loss runs for the two consecutive evaluations.

This approach should be seen as an initial indicator for internal informational purposes only, as many items go into determining the results generated in a full actuarial study. Actuaries use multiple methods, considering both unique and industry trends, to determine their best estimate of ultimate losses. Large fluctuations may occur over shorter time periods, as monthly or quarterly evaluations are more sensitive to the timing of claim payments and claims reviews, the age of recent policy years and exposure adjustments, among other items.

SIGMA’s actuaries are available to discuss the process for determining, accruing and reconciling reserves unique to your or your client’s business. Also see the Analytical Spring Cleaning article for more information regarding interim analytics available to monitor changes in loss reserves.

We welcome your feedback by posting a comment or contacting us at support@SIGMAactuary.com.

© SIGMA Actuarial Consulting Group, In