Over ten years ago, Tim Coomer developed the “Cone of Uncertainty” graphic and wrote a corresponding article on the decisions surrounding risk assumption and retention levels. When Tim heard about concepts that SIGMA’s clients struggled to comprehend, he would often prepare a “one pager” to add to our educational resource library. The “Cone of Uncertainty” graphic was no different and, in the time since its creation, it has been frequently used to demonstrate the increased loss variability associated with higher retentions.

As your firm considers which retention is most viable given current market conditions, we highly recommend using analytics and quantitative assessment to support this process. One such assessment is the aforementioned “Cone of Uncertainty,” and we have reprised Tim’s original article along with an updated version of the graphic below. The remainder of this blog primarily uses Tim’s wording with light editing for clarity and voice.

Let’s start by reviewing the concept of “The Cone of Uncertainty.” Tim was familiar with this concept from his days working in the “Star Wars” program that Ronald Reagan kicked off back in the 1980’s. However, he had not thought about that term until Michelle Bradley, ACAS, MAAA, one of SIGMA’s consulting actuaries, mentioned a concern about whether clients fully understand the risk they assume when moving from a low retention to a higher retention. The term “Cone of Uncertainty” popped into Tim’s mind, and he immediately visualized a graphic that would be helpful for brokers when explaining the realities of higher retentions.

To better explain this concept, let’s consider a small case study. Say, for example, you are the broker or risk manager for a manufacturing firm that is growing rapidly. Three years ago, the company moved their workers compensation program from a guaranteed cost program to a policy with a $100,000 per occurrence retention. After a positive experience, they now want to consider a $500,000 per occurrence policy. For purposes of this simple case study, we will ignore any aggregate limits.

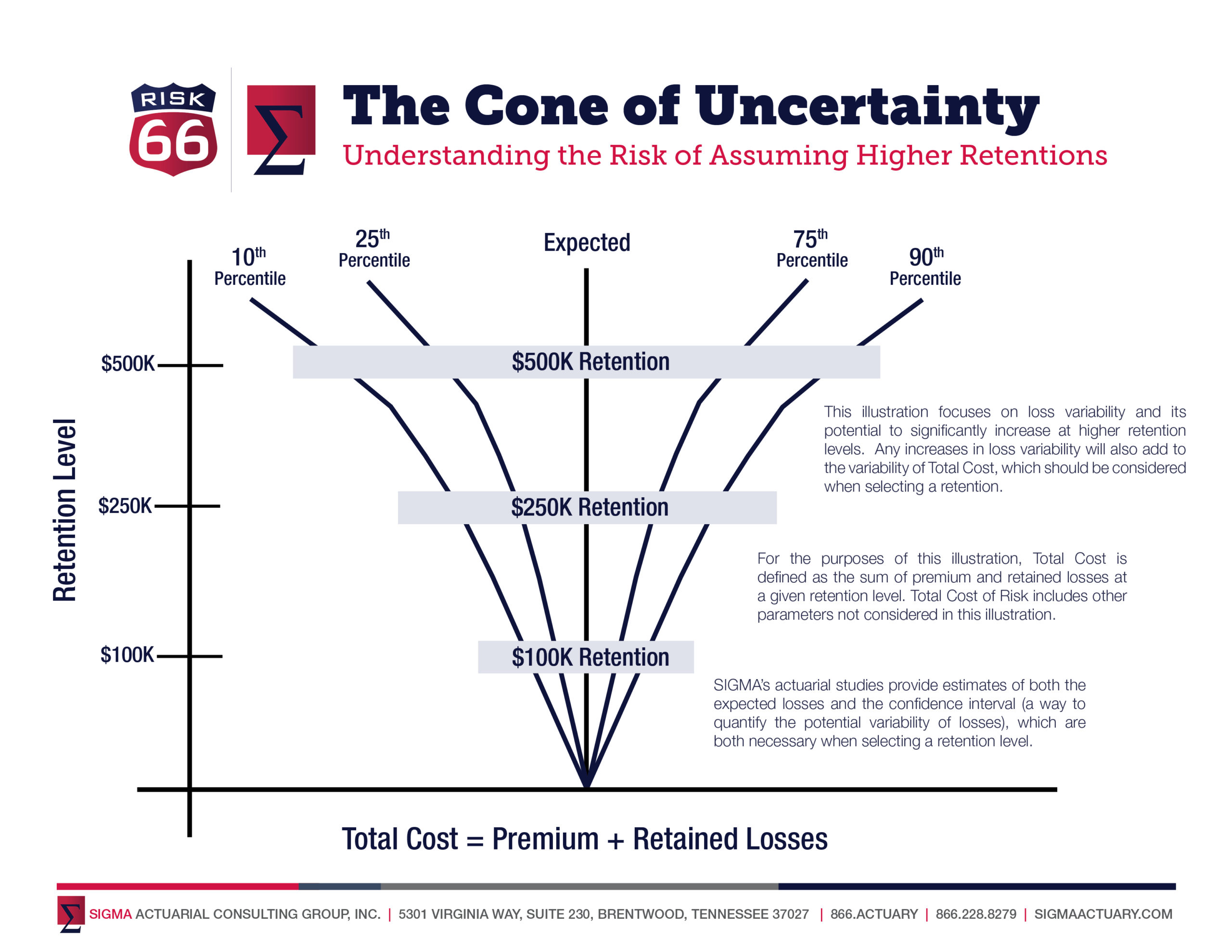

Typically, making this decision would involve reviewing the expected losses the employer might retain at the $100,000 retention and those retained at the $500,000 retention. Comparing this difference in retained losses to the difference in premium should make the decision is fairly straightforward, but is that actually the case? By increasing the retention, you have moved further up in the “Cone of Uncertainty” and are assuming an increased risk in the potential variability of losses.

SIGMA typically communicates this additional risk by completing a confidence interval analysis as part of our standard actuarial reports completed for a client. For more information on these types of analyses, we encourage you to read SIGMA’s Tech Talk: Understanding Confidence Intervals or download a copy of our booklet, Actuarial Advantage. Both can be found in SIGMA’s complementary resource library.

That said, the purpose of today’s blog is to discuss SIGMA’s Graphic: Understanding the Cone of Uncertainty, so let’s take a look at the graphic itself below (which may also be found in our resource library.):

As you can see, the concept demonstrated in this graphic is that increasing retention levels often increases the potential variability of the total cost of risk. This subtle point can be lost sometimes when a client faces the decision of whether to change their retention level. While the above graphic is always available for your own review purposes, we also hope it helps you introduce the topic of increased loss variability to your clients or colleagues.

SIGMA completes loss projection analyses on a regular basis which include the confidence level analysis mentioned above. These projections, along with the spread demonstrated in the confidence levels, provide analytical support for the question of increased variability at higher retentions. As such, we recommend discussing these topics in tandem.

If SIGMA can assist with the development of retention analyses for you or your clients, please contact us at support@SIGMAactuary.com or schedule a call with one of our consulting actuaries.

© SIGMA Actuarial Consulting Group, Inc.

Michelle, you are still rocking the actuarial world. I will share this to my people again.