January is here, and with it comes the need for many companies to complete their annual actuarial report for retained liabilities. If the past several years are any indicator, legislative changes and social inflation could significantly impact the loss reserves and projections prepared in these reports. Healthcare entities in particular could face the bulk of this activity, as evidenced by California's AB35 bill increasing the cap for damages on both a current and ongoing basis.

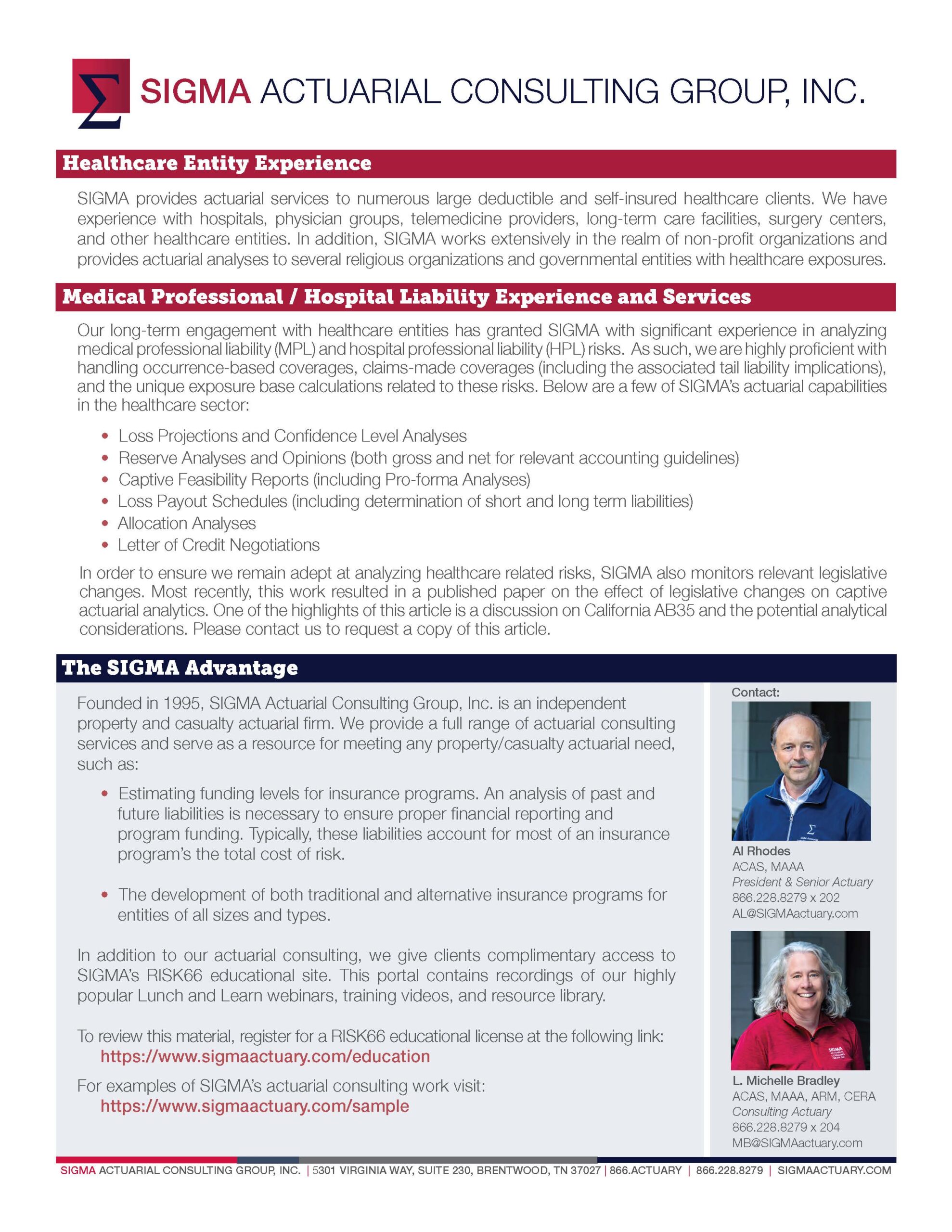

SIGMA has many years of experience providing analytical services to healthcare clients, which are covered in our latest one-page summary. The document outlines the types of analytical services SIGMA offers and highlights our experience with various types of healthcare entities.

Details on the analytical implications of legislative changes can be found in the recent 2023 Captive International article by Enoch Starnes and Michelle Bradley.

Of course, this one-page summary is just one of the many documents and videos found in our complimentary RISK66 education portal.

As always, SIGMA is available to discuss solutions to challenges unique to a particular company or industry. Schedule a call today with one of our consulting actuaries.

We welcome your feedback by contacting us at support@SIGMAactuary.com.

© SIGMA Actuarial Consulting Group, Inc.