At SIGMA, we often get asked “how big does a company have to be to benefit from an actuarial analysis?” The question usually suggests there is some minimum loss or premium level that would trigger the need for an actuarial analysis.

As you might imagine, it is typically more complicated than simply setting a threshold for premium or losses to determine potential benefit. For example, due to regulatory issues, some smaller clients are required to have an actuarial analysis possibly with a statement of actuarial opinion. Specific coverage issues such as retention and claim frequency may drive a medium sized company to consider alternative risk financing which will drive the need for an actuarial analysis.

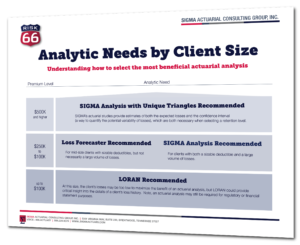

But, because we hear the question so often, we have put together a graphic that recommends the following:

Small clients – any small client can benefit from a quick snapshot of what their losses look like in terms of severity, location, cause of loss, injury type, and other parameters by which the data can be sliced and diced. LORAN is one of our RISK66 tools that analyzes a worker’s compensation loss run (other lines of coverages coming later in 2019) and quickly generates an insightful report.

250K to 500K Premium Level – for clients reaching above the 250K premium level, it begins to make sense for all risks to have a loss forecaster project generated, using the Loss Forecaster tool in RISK66, for several purposes. First, it is a good check on the price a client on a guaranteed cost plan is quoted. Second, if the client does have a small deductible, then it is a way to project the liability for the coming year and estimate the liability for past years. In some cases, for clients in this size range, a full actuarial analysis may be recommended for larger deductible levels or a unique circumstance where industry averages may not be applicable.

500K and Higher Premium Level – for clients with large premium levels an actuarial analysis is a necessity. The cost of an analysis is insignificant compared to the losses and premiums and can provide significant support to an analytical approach to minimizing the total cost of risk. The business world is pushing hard the need to make all decisions based on a solid analytical approach. In this premium level, both loss projections (looking forward) and loss reserves (looking at prior years) may have a significant impact on the income statement and balance sheet. Loss projections can be used for negotiations related to excess pricing and deciding on an optimal retention. The reserve analysis is useful to determine the balance sheet liabilities and can possibly be used in collateral negotiations.

Irrespective of the size of a client we would suggest that a full actuarial analysis is beneficial in several situations:

- Collateral negotiations – an actuarial analysis can review the years involved in the collateral and provide insights in the risk margins and volatility. A carrier’s workpapers could be reviewed as part of the process.

- Acquisition or divestiture – this could change the risk profile of a company and may be useful not only in terms of pricing the transactional liabilities but also pricing the go forward liabilities after the transaction.

- Complex risks – risks that are extremely low in frequency with high potential severity are likely to need an actuarial analysis with unique data supplemented with industry information.

Download this graphic and more educational resources from our complimentary education portal. Current subscribers can login and download the graphic here. To register for access, visit SIGMAactuary.com/education.

Download this graphic and more educational resources from our complimentary education portal. Current subscribers can login and download the graphic here. To register for access, visit SIGMAactuary.com/education.

Click here to schedule a call with SIGMA to discuss the benefits of an actuarial analysis.

We welcome your feedback by posting a comment or contacting us at support@SIGMAactuary.com.

© SIGMA Actuarial Consulting Group, Inc.